-

Posts

525 -

Joined

-

Last visited

Content Type

Forums

Events

Gallery

Posts posted by Subway

-

-

-

Thanks for the reply Dave. Glad to hear all is well! I've been tracking the hurricane listening to music. Have a good night.

-

1

1

-

-

What's up Dave?- Hope all is well!

-

1

1

-

-

welcome to the boomtown-pick a habit, we got plenty to go around----

more big 80's

-

3

3

-

-

Not a good day-Need some tunes

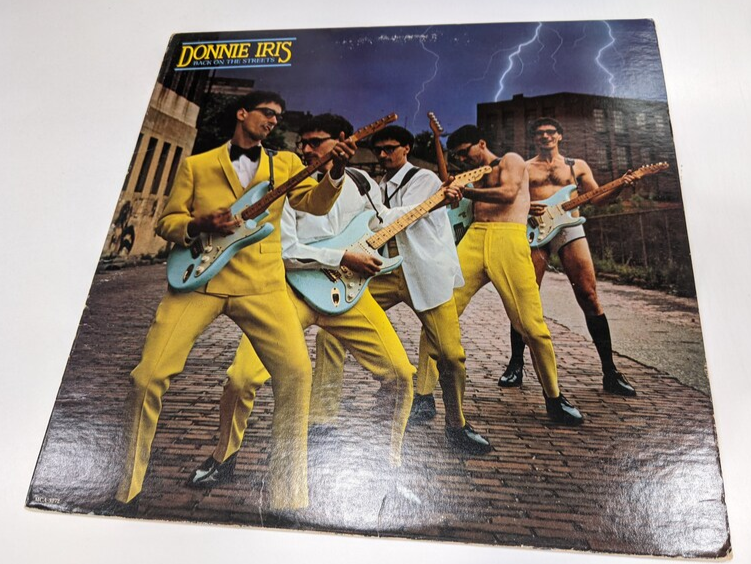

power duo: donnie iris & aldo nova w/ joe jackson bonus

-

2

2

-

1

1

-

-

the white album

-

1

1

-

1

1

-

-

-

The Bridge of Sighs functioned as a transfer for prisoners to the inquisitors’ offices where they were put on trial.

-

1

1

-

3

3

-

-

CHARLIE WATTS QUINTET

Charlie Watts, the Unlikely Soul of the Rolling Stones - The International Magazine

-

1

1

-

2

2

-

-

the most important tech company you’ve never heard of ????????

ASML And Other Large Eurozone Stocks Back In Fashion - BizPlus

-

Schizoid Man

-

3

3

-

1

1

-

-

Destroyer

-

4

4

-

1

1

-

-

Season of the Witch

-

3

3

-

1

1

-

-

19 hours ago, Full Range said:

If you think that was great

Have a listen to My Stars - From the Billon Dollar Babies album

ALICE DOC

-

4

4

-

-

36 minutes ago, billybob said:

🔨🔨🍰

Hammer Cheese???????? Cheese Hammer??????????

or is that cake? Pound Cake?

-

1

1

-

-

" Indeed, the prospects for acquiring and building wealth appeared bleak. GERMAN ARMY ATTACKS POLAND; CITIES BOMBED, PORT BLOCKADED;DANZIG IS ACCEPTED INTO REICH. The unemployment rate in 1939 was at 17.2 percent. Widespread bank runs had decimated people’s savings and trust in financial institutions. The most logical strategy at the time was to stuff your money in a mattress. Many people did. But not everyone…"

-

@JohnJ "I lucked into about two hundred pounds of vinyl in mostly great shape last year".

Sweet find- awesome! "Tumbleweed" - Amorena, Talking Old Soldiers, Burn Down- Good album

-

3

3

-

-

Rocket Man

-

3

3

-

-

She Wants Revenge (joy divison-ish)

Transmission

-

4

4

-

-

Depeche Mode - Never Let Me Down Again - Live - (diggin the back-up singers)

-

3

3

-

1

1

-

-

I shall

-

1

1

-

1

1

-

-

"Boot is a professor of finance at the University of Amsterdam in the Netherlands. Hoffman and Laeven are economists with the European Central Bank, where Ratnovski has been seconded from his job as an IMF economist. IMF Blog is a forum for the views of the International Monetary Fund (IMF) staff and officials on pressing economic and policy issues of the day. The views expressed are those of the author(s) and do not necessarily represent the views of the IMF and its Executive Board.”

If following link doesn't function, go to IMF Blog & search for article.

What is Really New in Fintech – IMF Blog

Excerpt:

“New types of information

The most transformative information innovation is the increase in use of new types of data coming from the digital footprint of customers’ various online activities—mainly for credit-worthiness analysis.

Credit scoring using so-called hard information (income, employment time, assets and debts) is nothing new. Typically, the more data is available, the more accurate is the assessment. But this method has two problems. First, hard information tends to be “procyclical”: it boosts credit expansion in good times but exacerbates contraction during downturns.

The second and most complex problem is that certain kinds of people, like new entrepreneurs, innovators and many informal workers might not have enough hard data available. Even a well-paid expatriate moving to the United States can be caught in the conundrum of not getting a credit card for lack of credit record, and not having a credit record for lack of credit cards.

Fintech resolves the dilemma by tapping various nonfinancial data: the type of browser and hardware used to access the internet, the history of online searches and purchases. Recent research documents that, once powered by artificial intelligence and machine learning, these alternative data sources are often superior than traditional credit assessment methods, and can advance financial inclusion, by, for example, enabling more credit to informal workers and households and firms in rural areas.”

-

1

1

-

-

you are correct. have a drink on me!

-

Thanks Chad for resolution posted under

:format(jpeg):mode_rgb():quality(90)/discogs-images/R-4807913-1514009390-2510.jpeg.jpg)

Some Recommendations When Responding To Those Asking For Klipsch Speaker Models For Their Needs

in General Klipsch Info

Posted

I’ve read the reviews, heeded advice and listened to systems when presented. It’s been a journey of trial and error for me. Knew very little to nothing about audio in the beginning and still don’t compared to majority on forum. Journey began with Denon and Polk from big box retailer. Stereo bugs hits and buy Bose 901 lifestyle system-return it. Soon after decided I wanted to learn to play guitar. Purchased acoustic then electric guitar & 15-watt tube amp; because read SRV used tube amps, I liked his tone. Was amazed how good and loud the 15wt tube amp sounded. If guitar tube amp sounds good shouldn't a tube stereo amp sound good? Is there such a thing as tube stereo amp? I know I don’t enjoy exaggerated bass. What brand/type of speakers do I need? What are horn speakers? Acquired vintage tube stereo amp and Bozak Urbans-sound good, full, and rich. Could better sound be achieved? Keep reading/seeing adverts about ‘home-theater’ systems. Purchase Bose lifestyle with 5 mini speakers and subwoofer. I preferred two channel (and later at times three channel) and reconfirmed the bass response I desired. Discover neighbor had high end tube amps & big B&W floor standers. His system sounded good, but it’s not the sound I’m hearing in my head (yes, crazy at this point). Reading, researching continues. What’s this “magic” of tube amps and horn speakers I read about? So begins the auditioning when able, buying, keeping or selling speakers. Klipsch were the keepers. Same with amps and other electronics- audition, buy, keep or sell.

402’s, Benchmark, First Watt, and D amps have now piqued my interest.