-

Posts

2822 -

Joined

-

Last visited

-

Days Won

3

sputnik last won the day on October 31 2021

sputnik had the most liked content!

Profile Information

-

Gender

Not Telling

-

Location

Tropical Montana

Recent Profile Visitors

5937 profile views

sputnik's Achievements

Forum Ultra Veteran (5/9)

1.6k

Reputation

-

Just got home from my eclipse chase. Planned on Texas but ended up in Bloomington, IN. Still processing my images but here is good sampling. Tap an image for better resolution.

-

-

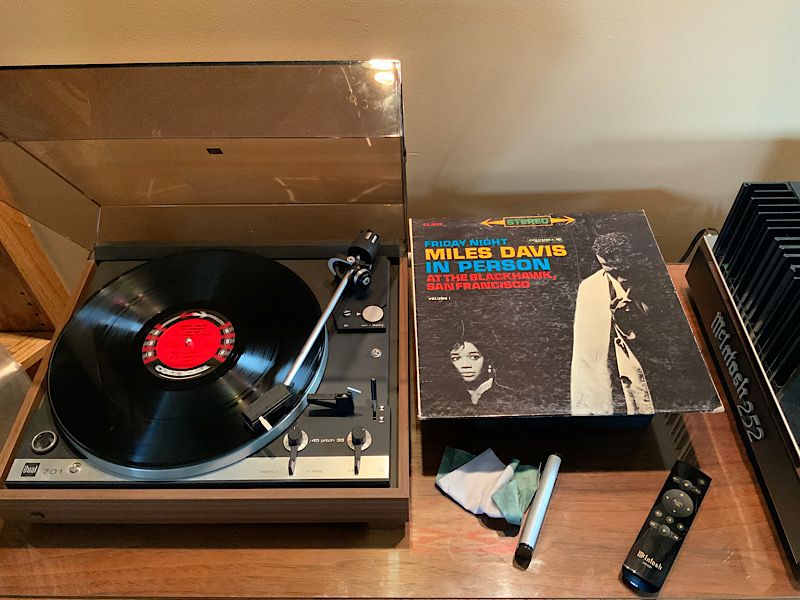

Very impressive collection! I only have a handful of Miles Davis albums. I didn’t see these two on your list.

-

-

The big clocks made me think of Dark Side of the Moon. Would’ve been incredible to listen to that in there.

-

Yeah, it cost him more than money but it sounds like he was willing to pay that price too according to the article. Drove his first wife to drinking, oldest estranged son wished him a slow death, and he simply alienated the rest. After he died, the whole shooting match was pieced out for fifteen cents on the dollar. Sad end to a sad story.

-

I lifted this post from another forum ( https://forums.thepaceline.net/showthread.php?t=303204 )but thought it might be of interest here. Not sure if this has ever been posted here - I did a quick forum search and found no history. The WAPO article is a cautionary tale. Hope the links work. Please pardon me if this is a repost. Ken Fritz. Approximately $1,000,000 USD. 27 years. A very custom 1,650 square foot addition to his house. 35,000 watt amplifiers. A 1,500 pound (680 kg) turntable with three arms. Three 10 foot main speakers, four 7 foot surround speakers, 24 subwoofers. Just one little excerpt - Quote: “He crafted by hand the three 10-foot speakers that loomed like alien monoliths at the head of the room, with the help of Paul Gibson, a former employee at his fiberglass company. Each 1,400-pound slab pulsed with 24 cone drivers for the deeper tones and 40 tweeters — 30 shooting into the room, 10 toward the crimson curtains draping the wall behind — to project the upper-range sounds.” Gift link. Possibly time limited. https://wapo.st/47ErwZI https://wapo.st/47ErwZI Video https://m.youtube.com/watch?v=4b2IOOhJmxw

-

He was younger than I thought. https://pitchfork.com/news/shane-macgowan-pogues-frontman-dies-at-65/?bxid=616c2030ed60cb707620602c&cndid=66930675&esrc=bouncexmulti_first&hasha=96b835c05a4da880fe98fd8a855a1f01&hashb=a66538b13e912fa022cf7f3ee7bf1df07d83bc72&hashc=95a75bccfc5f35caf8294aa60f445523d713ec9c2234f05de73ace4b7a340332&utm_brand=p4k&utm_campaign=aud-dev&utm_mailing=P4K_HotLinks_113023&utm_medium=email&utm_source=nl&utm_term=P4K_HotLinks_NewMusic This tribute version was just posted on YouTube.

- 1 reply

-

- 2

-

-

Retirement sale coming. Updated with some pricing 11/26

sputnik replied to USNRET's topic in Garage Sale

I’m looking to downsize too but I’m still interested in the Bluesound Node…. -

Did the F2 passive have a larger dia. passive than the F1?

-

https://people.com/movies/raquel-welch-dead-life-in-photos/

-

Do you really want her to know?